What is Zoho Books?

Zoho Books is a modern cloud-based accounting solution designed for businesses of all sizes. From managing invoices and tracking expenses to handling GST compliance, Zoho Books streamlines your financial operations and automates routine tasks, making accounting hassle-free for entrepreneurs, freelancers, startups, and growing companies.

Key Features of Zoho Books

Automated Invoicing:

Quickly create, send, and track invoices. Automate recurring bills and accept online payments with ease.

- Expense Management:

Capture expenses via web or mobile, categorize costs, and monitor where your money goes. - Bank Reconciliation:

Connect your bank, credit card, or payment gateways for automatic data sync and real-time transaction matching. - GST & Tax Filing:

Effortlessly generate tax-ready reports, including GST returns, TDS calculations, and VAT compliance (supports global regulations). - Inventory Tracking:

Manage stock, track orders, and control warehouses right from your accounting dashboard. - Project Billing:

Track billable hours, collaborate with your team, and create project-based invoices. - Multi-Currency Support:

Deal with international clients and vendors easily—Zoho Books handles exchange rates and currency conversions.

Integrations

Zoho Books works seamlessly with:

- Zoho CRM: Sync customer data, automatically generate invoices or bills linked to deals.

- Zoho Inventory: Real-time inventory updates, unified purchase and sales order management.

- Banking & Payment Gateways: Integration with DBS, ICICI, PayPal, Stripe, Razorpay, and more.

- Zoho Payroll, Zoho Projects, and Third-Party Apps: Connect your HR, project management, and business tools for 360° operations.

Real-World Benefits

- Save Time:

Automation reduces manual entry and recurring accounting chores. - Get Paid Faster:

Accept payments instantly and send payment reminders. - Stay Compliant:

GST-ready reports make tax season stress-free. - Grow With Confidence:

Dashboard analytics help you make smarter, data-driven financial decisions.

Zoho Books Pricing (as of October 2025)

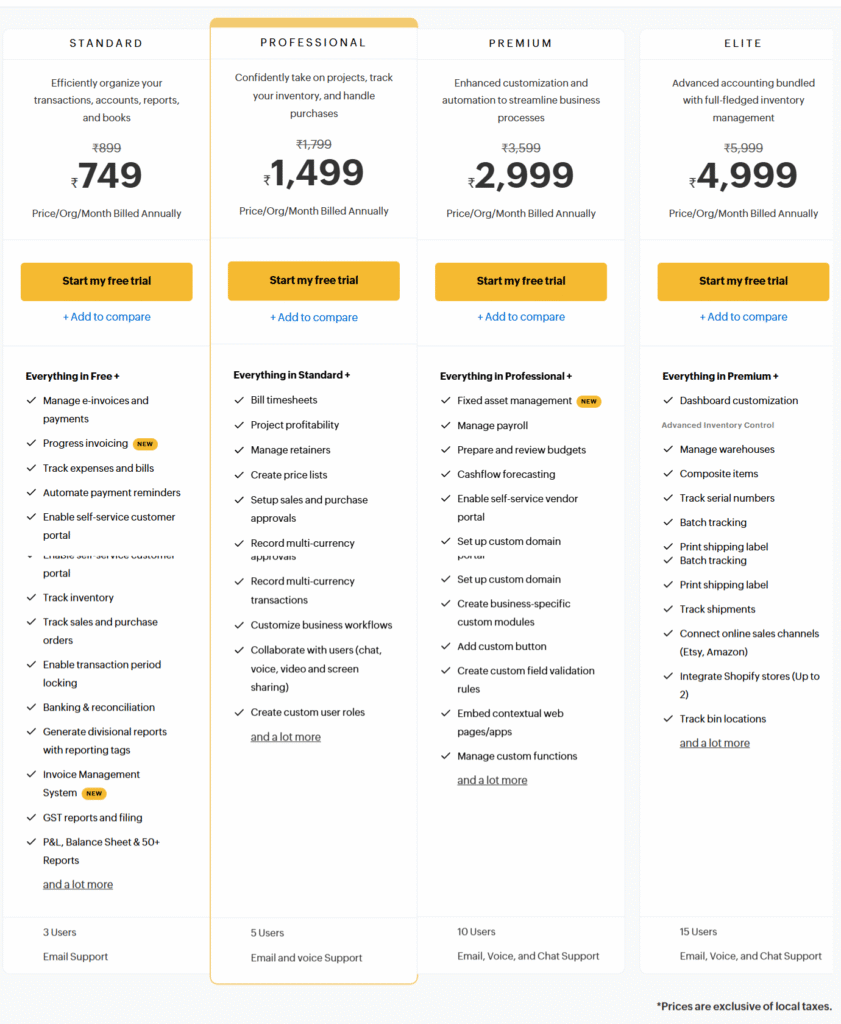

Zoho Books offers flexible plans to suit different business needs. Here’s a simple breakdown ([country-specific pricing may vary]):

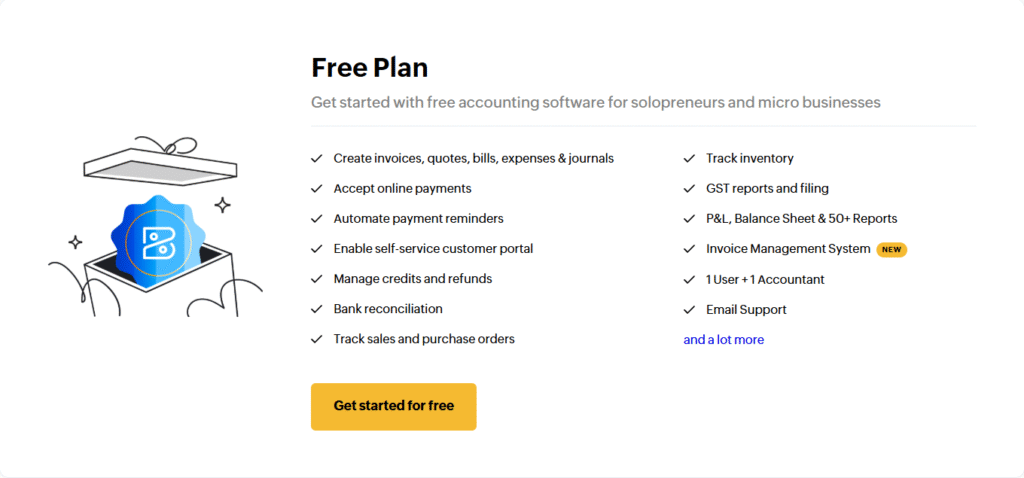

- Free Plan: For businesses with revenue below the government threshold (limited features).

- Standard Plan: ₹749/month (billed annually) — 3 users, invoicing, expenses, banking, projects, and more.

- Professional Plan: ₹1,499/month (billed annually) — Standard features + bills, vendor credits, purchase orders, and inventory.

- Premium Plan: ₹2,999/month (billed annually) — Advanced reporting, workflow automation, budgeting, 10 users, and unlimited custom modules.

All plans come with a 14-day free trial.

Use Cases & Success Stories

- Small Business Owners: Automate billing, track payments, and file GST returns without an accountant.

- E-Commerce Businesses: Sync inventory and orders for accurate financial data.

- Consultants & Agencies: Track project expenses, bill clients, and collaborate with your team.

“Zoho Books made our tax season smooth and stress-free—automation saved us hours every month!” — Real User Review

Quick FAQ

Q: Can I switch to Zoho Books from another software?

A: Yes! Zoho Books provides migration tools and onboarding support for popular systems like Tally, QuickBooks, and Excel.

Q: Is Zoho Books GST compliant?

A: 100%. Zoho Books is built for GST, TDS, VAT, and other tax regimes worldwide.

Q: Does Zoho Books have a mobile app?

A: Yes, available for Android and iOS, with most core features included.

Start Your Free Trial

Ready to take control of your finances?

Try Zoho Books free for 14 days!